LOAN TYPE

LOAN TYPE

HOW WE LOAN

At Integrity Private Capital, we are committed to providing reliable capital in the commercial real estate industry. We work with real estate investors, mortgage brokers, and private lenders to provide quality real estate private loans. Our team has expansive experience over a combined 60 years in all facets of the industry. Our experience includes brokerage, property management, appraisal, property acquisitions, property renovations, and dispositions.

It is our goal to guide you through the real estate investment life cycle, starting with the application process, and all the way through to exit.

HOW WE LOAN

At Integrity Private Capital, we are committed to providing reliable capital in the commercial real estate industry. We work with real estate investors, mortgage brokers, and private lenders to provide quality real estate private loans. Our team has expansive experience over a combined 60 years in all facets of the industry. Our experience includes brokerage, property management, appraisal, property acquisitions, property renovations, and dispositions.

It is our goal to guide you through the real estate investment life cycle, starting with the application process, and all the way through to exit.

AVAILABLE LOANS

COMMERCIAL BRIDGE LOANS

A bridge loan is a short-term loan designed to “bridge the gap” between the acquisition of a property to the placement of permanent financing. This real estate private loan can be used for any reason. Because financing from traditional banks and institutional lenders can be a lengthy and pain staking process, real estate investors seek bridge loans to secure the acquisition of a property while they continue to work toward putting permanent financing in place.

Terms can range anywhere from six months to three years and are generally interest-only.

AVAILABLE LOANS

COMMERCIAL BRIDGE LOANS

A bridge loan is a short-term loan designed to “bridge the gap” between the acquisition of a property to the placement of permanent financing. This real estate private loan can be used for any reason. Because financing from traditional banks and institutional lenders can be a lengthy and pain staking process, real estate investors seek bridge loans to secure the acquisition of a property while they continue to work toward putting permanent financing in place.

Terms can range anywhere from six months to three years and are generally interest-only.

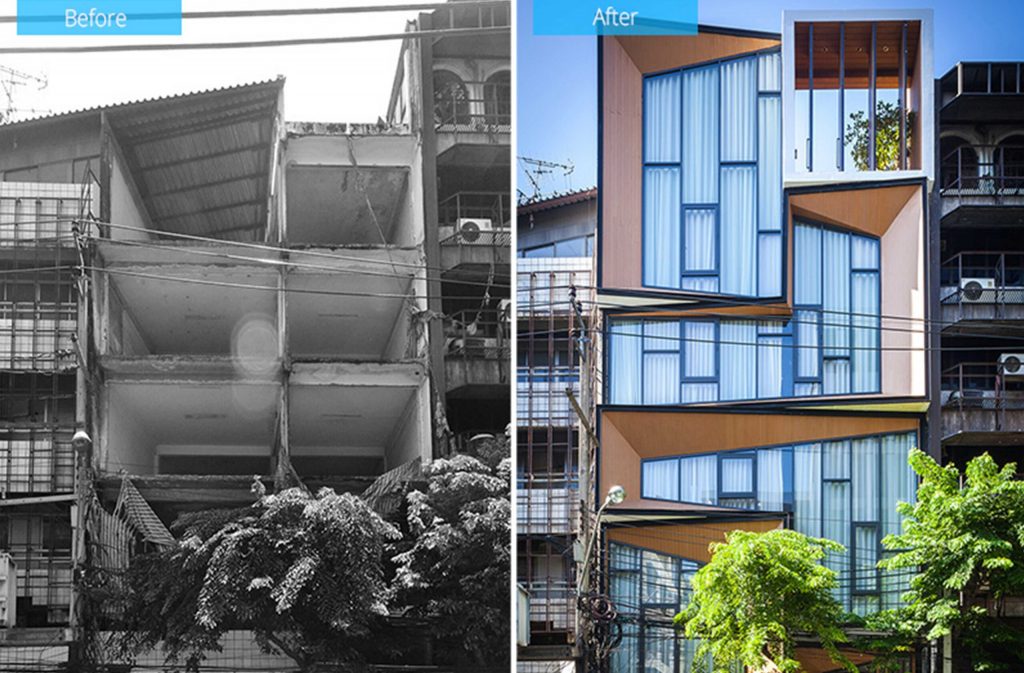

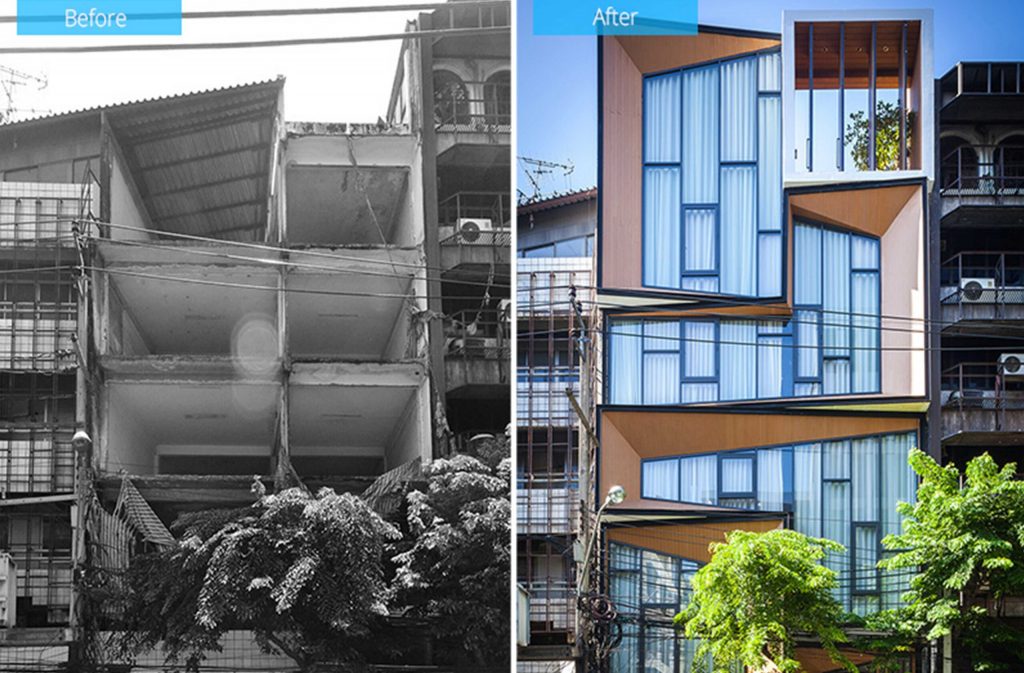

VALUE ADD LOANS

Traditional banks and institutional lenders often see distressed real estate as too risky and will refuse to provide financing for such properties. Distressed can mean the property needs major improvements or has a high vacancy rate. When banks refuse this type of loan, value add financing steps in.

This financing requires diligence and creativity, and the capital can be provided for the acquisition, renovation, and lease-up of a property.

VALUE ADD LOANS

Traditional banks and institutional lenders often see distressed real estate as too risky and will refuse to provide financing for such properties. Distressed can mean the property needs major improvements or has a high vacancy rate. When banks refuse this type of loan, value add financing steps in.

This financing requires diligence and creativity, and the capital can be provided for the acquisition, renovation, and lease-up of a property.

ACQUISITION LOANS

Sometimes real estate investors simply require a traditional acquisition loan, but for one reason or another may not fit the lending criteria of traditional banks. As such, they are deemed to be risky borrowers. The benefit of private capital is the loan being largely based on the asset and less on the qualifications of the borrower.

While interest rates will be higher than they are with banks, this type of loan helps real estate investors secure valuable property acquisitions that they otherwise would not have been able to acquire.

ACQUISITION LOANS

Sometimes real estate investors simply require a traditional acquisition loan, but for one reason or another may not fit the lending criteria of traditional banks. As such, they are deemed to be risky borrowers. The benefit of private capital is the loan being largely based on the asset and less on the qualifications of the borrower.

While interest rates will be higher than they are with banks, this type of loan helps real estate investors secure valuable property acquisitions that they otherwise would not have been able to acquire.

CASH-OUT LOANS

Cash-out loans allow real estate investors to access equity in their properties for any reason. Banks are generally unwilling to allow borrowers to increase their loan amounts even when the property and its borrower are stable. In this case, a cash out bridge loan provides much needed capital to borrowers secured by the property’s equity.

CASH-OUT LOANS

Cash-out loans allow real estate investors to access equity in their properties for any reason. Banks are generally unwilling to allow borrowers to increase their loan amounts even when the property and its borrower are stable. In this case, a cash out bridge loan provides much needed capital to borrowers secured by the property’s equity.

FIX AND FLIP

A fix and flip loan is a loan designed to allow investors to acquire, renovate (fix), and re-sell residential properties for a profit.

FIX AND FLIP

A fix and flip loan is a loan designed to allow investors to acquire, renovate (fix), and re-sell residential properties for a profit.

Others

Have a unique need that doesn’t fit the loan types found here?

Contact us at 909-482-1060 or through the link below, as we are eager to use our experience to find a creative solution for you.